unlevered free cash flow dcf

Remember the discounted cash flow DCF method of valuing companies is on a forward-looking basis and the estimated value is a function of discounting future free cash flows FCFs to the present day. Web See also this article which explains a bit more what you should know about the DCF method.

Levered Free Cash Flow Tutorial Excel Examples And Video

If we assume that WACC 11 and that the appropriate long-term growth rate is 1 we get.

. Web This template includes unlevered free cash flow UFCF calculation which refers to your companys cash flow prior to accounting for financial obligations. However in practice the FCFF approach and unlevered DCF are used across most industries. Unlevered free cash flows change in financial debt interest.

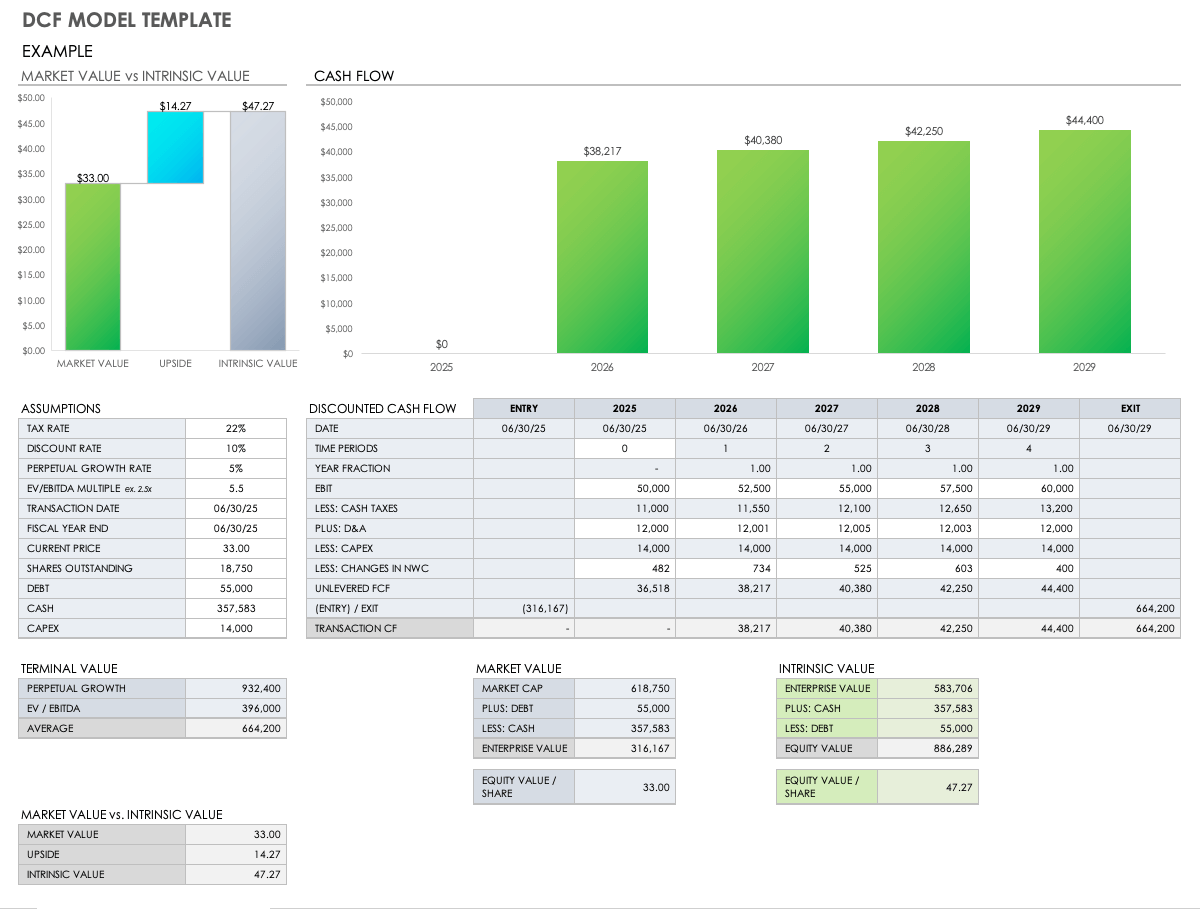

Web In a discounted cash flow DCF model the intrinsic value of an investment is based on the projected cash flows generated which are discounted to their present value PV using the discount rate. Web Download a free DCF model template to calculate the net present value NPV of a business using a discount rate and free cash flow. R the discount rate aka.

Levered Free Cash Flow. This is a very conservative. Unlevered free cash flow can be reported in a companys.

For a property cash flow projection it can cover periods up to 10 years and allow to value of the property based on the present values of their future cash flows. Tax rate The tax rate the company is expected to face. The Weighted Average Cost of Capital WACC covered in the next section of this training course.

When it comes to DCF valuation analysis a solid real estate spreadsheet will be required. The first step in a DCF valuation is to find the free cash flow FCF of a company. G the perpetual growth rate.

3-Statement Modeling DCF Comps MA and LBO. Web DCF Analysis is a valuable Business Valuation technique as it evaluates the intrinsic value of the business by looking at the cash-generating ability of the business. DCF MA LBO Comps and Excel Modeling.

Web There are two main types of free cash flows which can be referred to. FCF n last projection period Free Cash Flow Terminal Free Cash Flow. Using a Cash Flow Projection Template for your Budget or Business Plan.

Web Get more on Unlevered Free Cash Flow in our YouTube channel. How to Value a Business Using the Discounted Cash Flow Model. How to calculate Residual Land Value.

For this reason the formula for measuring a companys unlevered free cash flow starts with the net operating profit after taxes NOPAT which taxes the. Levered free cash flows free cash flows to equity shareholders. This represents a companys GAAP-based operating profit.

Web Since free cash flow to equity FCFE represents the cash left over after meeting all financial obligations and re-investment needs to remain operating. Web Free Cash Flow to the Firm FCFF also referred to as unlevered Free Cash Flow to Equity also knows as levered. Unlevered An Internal Rate of Return Example.

The customizable template includes annual DCF analysis. The differentiator between these metrics is the way they treat debtWhen debt principle payments and interest are included in the calculation FCF is said to be leveredWhen interest expenses and principle are excluded FCF is said to be unleveredThe nuance is that when FCF includes interest expense but. DCF Model Training Terminal Value EBIAT NOPAT Unlevered Free Cash Flow NOPLAT Discount Factor Mid-Year Convention Stock Based Compensation in DCFs Reverse DCF Model.

In order to gain an intuitive understand of Free Cash Flow to Firm FCFF let us assume that there is a guy named Peter who started his business with some initial equity capital let us assume 500000 and we also assume that he takes a bank loan of another 500000 so that his overall finance capital stands at. Web Discounting Levered Free Cash Flows. Unlevered Free Cash Flow UFCF.

If youre building an unlevered discounted cash flow DCF model the weighted average cost of capital WACC is the appropriate cost of capital to use when discounting the unlevered free cash flows. Web Levered free cash flow is the amount of capital a company has remaining after accounting for payments to settle financial obligations. Web Step 1.

Learn Financial Statement Modeling. Often used interchangeably with the term unlevered free cash flow the FCFF metric accounts for all recurring operating expenses and re-investment expenditures. Web In this case.

WACC is the expected annualized return over the long term if you invest proportionately in all parts of the companys capital structure Debt Equity Preferred Stock. This cash flow is available to both debt and equity investors. Web Unlevered Free Cash Flow.

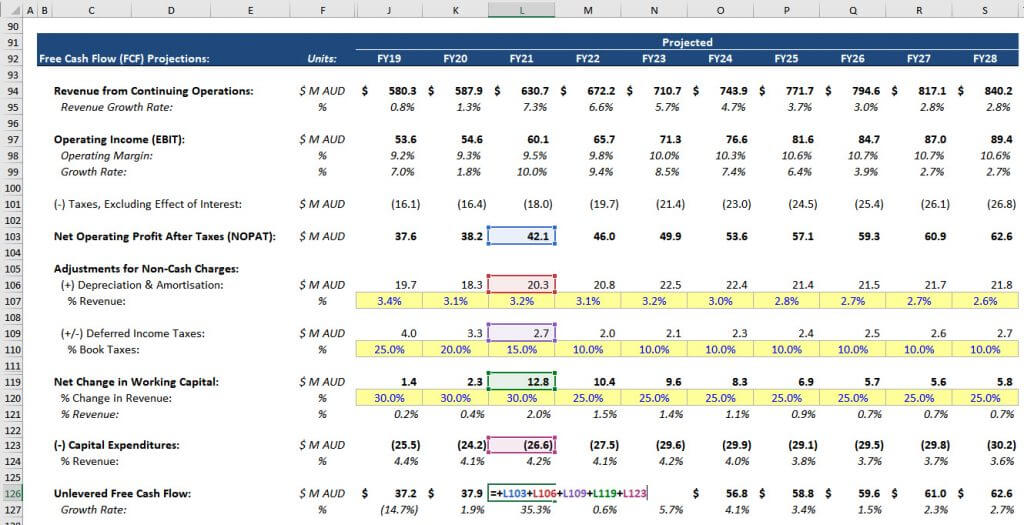

EBIT 1-tax rate CAPEX Addback Depreciation Change in Net Working Capital. Web Free Cash Flow Conversion is a liquidity ratio that measures a companys ability to convert its operating profits into free cash flow. Web But since the WACC already factors this in the calculation of unlevered free cash flow does NOT account for these tax savings otherwise youd be double-counting the benefit.

The WACC is the rate at which a companys future cash flows need to be discounted to arrive at a present value for the business. Keep apprised of your companys valuation based on expected cash flow streams with this DCF valuation model template. Discounted Cash Flow or DCF models are based on the premise that investors are entitled to the free cash flow of a firm and therefore the model is based solely on the timing and the amount of those cash flows.

Similar to unlevered free cash flows FCFs the WACC represents the cost of capital to all capital providers eg. Effective Cost of Debt. Web What is FCFF.

Explain what WACC means intuitively and how you might calculate each component of it ANSWER. Cash flow in the DCF formula is sometimes denoted as CF1 cash flow for 1st year CF2 cash flow for 2nd year and so on. Web Unlevered Free Cash Flow - UFCF.

Web Calculating Unlevered Free Cash Flows FCF Here is the formula for unlevered free cash flow. EBIT Earnings before interest and taxes. The difference between the two can be traced to the fact that Free Cash Flow to Firm.

FCFF stands for free cash flow to firm and represents the cash generated by the core operations of a company that belongs to all capital providers both debt and equity. Unlevered free cash flow UFCF is a companys cash flow before taking interest payments into account. FCF EBIT x 1- tax rate DA NWC Capital expenditures.

Get 27 financial modeling templates in swipe file. Web Free Cash Flow or Unlevered Free Cash Flow is the cash left over after the company deducts operating expenses and CapEx capital expenditures. The one notable exception is financial institutions.

Financial Ratios Analysis and its Importance. Web IRR levered vs. FCFF vs FCFE or Unlevered Free Cash Flow vs Levered Free Cash Flow.

Web The Weighted Average Cost of Capital WACC is one of the key inputs in discounted cash flow DCF analysis and is frequently the topic of technical investment banking interviews. List of Financial Model Templates Explore and download the free Excel templates below to perform different kinds of financial calculations build financial models and documents and create professional charts and. Real Estate Financial Modeling in Excel.

The Wall Street Prep. Web DCF Model Training Terminal Value EBIAT NOPAT Unlevered Free Cash Flow NOPLAT Discount Factor Mid-Year Convention Stock Based Compensation in DCFs Reverse DCF Model Levered DCF Model Common DCF Model Mistakes Football Field Valuation. Once all the cash flows are discounted to the present date the sum of all the discounted future cash flows represents the implied intrinsic value.

Web 1 What is Free Cash Flow to Firm or FCFF. Unlevered free cash flows free cash flows to firm. FCF measures a companys financial performance and shows the amount of cash a company has remaining after accounting for operating expenses and capital expenditures CapEx.

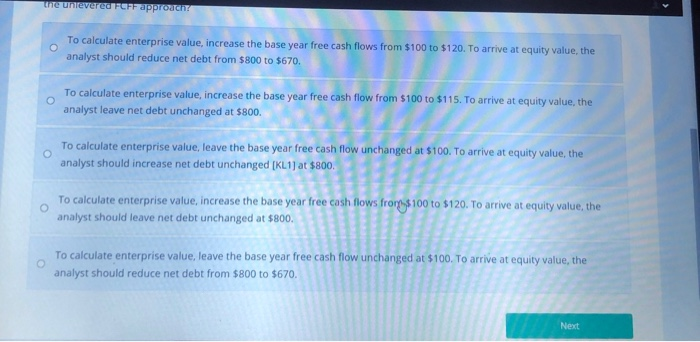

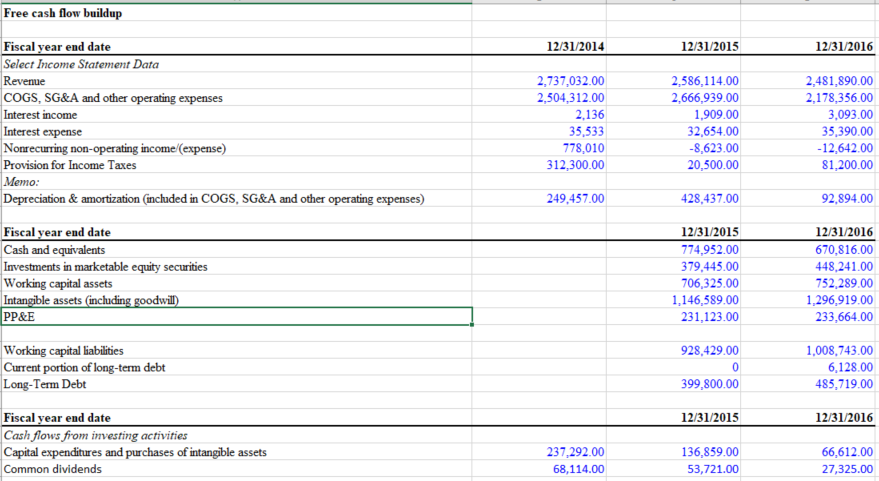

Solved Question 18 Of 23 An Analyst Is Building A Dcf Using Chegg Com

How To Value A Company Using Discounted Cash Flow Analysis Dcf Stockbros Research

Business Valuation Models Two Methods 1 Discounted Cash Flow 2 Relative Values Ppt Download

Building A Dcf Using The Unlevered Free Cash Flow Formula Fcff

Discounted Cash Flow Dcf Provamark Documentation

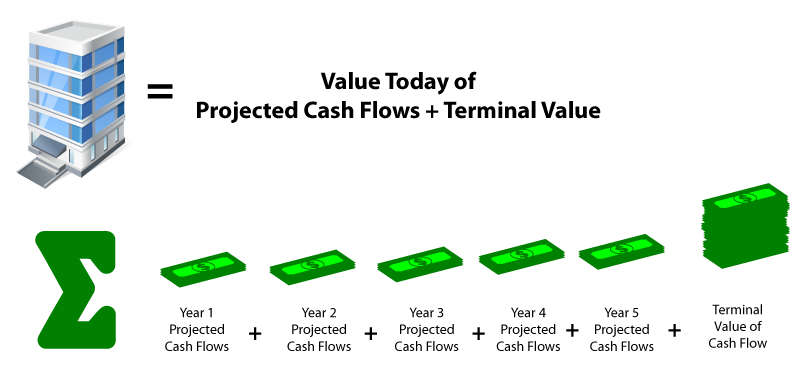

Free Cash Flow Buildup 12 31 2014 12 31 2015 Chegg Com

Discounted Cash Flow Dcf Valuation Investment Guide

Levered Free Cash Flow And The Levered Dcf The Most Useless Concepts In Valuation Youtube

Levered Free Cash Flow Tutorial Excel Examples And Video

Dcf Model Full Guide Excel Templates And Video Tutorial

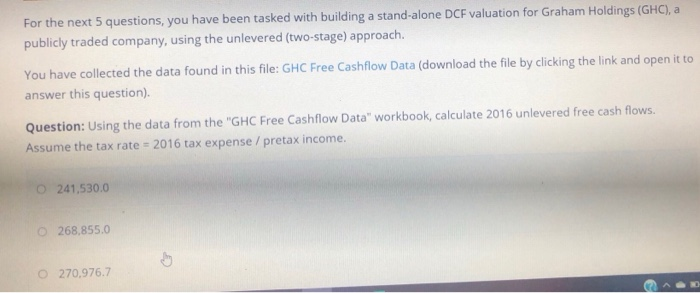

For The Next 5 Questions You Have Been Tasked With Chegg Com

How To Calculate Unlevered Free Cash Flow In A Dcf

Unlevered Free Cash Flow What Goes In It And Why It Matters Youtube

Unlevered Free Cash Flow Ufcf Formula And Calculation

Free Discounted Cash Flow Templates Smartsheet

Fcff Vs Fcfe Differences Valuation Multiples Discount Rates

Free Cash Flow Yield Formula And Calculation

Free Cash Flow Yield Formula And Calculation

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial